In the fast-paced world of investing, staying ahead of market trends and rumors can provide a crucial edge. As we dive into August 2024, several trade rumors are making waves, each with potential implications for various sectors and asset classes. This article breaks down these rumors, offering key insights for investors aiming to make informed decisions.

Understanding Trade Rumors

Trade rumors often circulate in financial markets, reflecting speculation about potential deals, mergers, acquisitions, or strategic shifts within companies. While some rumors may turn out to be speculative or unfounded, others can signal significant changes that might affect stock prices and investment strategies. For investors, it’s crucial to distinguish between credible information and speculative chatter.

1. Tech Sector Consolidation: The Impact of Mergers and Acquisitions

Rumor Overview: Recent speculation suggests that major tech giants are eyeing acquisitions to expand their market reach and technological capabilities. Companies like Apple, Microsoft, and Google are rumored to be in talks with various startups and established firms in the artificial intelligence and cloud computing sectors.

Key Insights:

- Market Reaction: Historically, rumors of tech sector consolidation can lead to increased volatility in tech stocks. Companies rumored to be targets of acquisitions often see their stock prices rise, while acquirers may experience short-term dips due to the costs and integration challenges associated with mergers.

- Strategic Considerations: For investors, evaluating the strategic fit of these potential acquisitions is essential. Assessing how well the target company’s technology or market position aligns with the acquiring company’s long-term goals can provide insights into the potential success of the merger.

- Due Diligence: Monitoring official announcements and financial reports of the involved companies is critical. Trade rumors can sometimes precede or follow significant business developments, making it essential to stay informed about confirmed news.

2. Healthcare Sector Shake-Up: New Drug Approvals and Regulatory Changes

Rumor Overview: There are rumors that several pharmaceutical companies are on the verge of securing FDA approvals for groundbreaking treatments. Additionally, regulatory changes are speculated to be in the pipeline, potentially impacting drug pricing and market access.

Key Insights:

- Investment Opportunities: Positive news regarding drug approvals can drive substantial gains for pharmaceutical stocks, especially for companies with a strong pipeline of innovative treatments. Investors should assess the potential market size and competition for these new drugs.

- Regulatory Impact: Changes in regulations can have broad implications for the healthcare sector. For instance, tighter regulations may increase compliance costs for companies, while more favorable regulations could enhance market access and profitability.

- Risk Management: Investing in healthcare stocks involves understanding the broader regulatory environment and potential legislative impacts. Keeping abreast of policy changes and FDA decisions can help in managing risks associated with healthcare investments.

3. Energy Sector Dynamics: Shifts in Oil and Gas Investments

Rumor Overview: Recent trade rumors indicate shifts in investment strategies within the energy sector. Major oil and gas companies are rumored to be pivoting towards renewable energy projects, influenced by changing global energy policies and investor pressures for sustainability.

Key Insights:

- Sector Transition: The move towards renewable energy could lead to long-term growth opportunities in sectors such as solar and wind power. Investors should evaluate how well traditional energy companies are adapting to these changes and the potential impact on their financial performance.

- Investment Trends: As energy companies diversify their portfolios, they may experience fluctuations in stock prices. It’s important to assess how these strategic shifts align with broader energy market trends and policy changes.

- Sustainability Focus: Investors should consider the sustainability of these transitions and their potential to create value. Companies with a clear and viable strategy for integrating renewable energy can be promising investment opportunities.

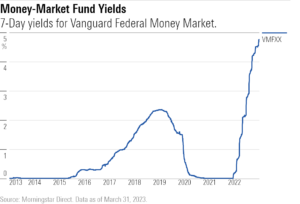

4. Financial Sector Developments: Changes in Banking Regulations

Rumor Overview: There are speculations about impending changes in banking regulations, including potential reforms aimed at enhancing transparency and reducing systemic risks. These changes could impact major banks and financial institutions.

Key Insights:

- Regulatory Effects: New regulations could affect profitability and operational efficiency for banks. Investors should monitor the potential implications for key financial metrics such as capital adequacy, liquidity, and risk management.

- Sector Performance: Historical data suggests that regulatory changes can lead to short-term market fluctuations but may offer long-term benefits by fostering a more stable financial environment. Evaluating the potential benefits and challenges of these reforms can guide investment decisions.

- Investment Strategy: For investors, staying informed about regulatory proposals and their potential impacts on financial institutions is essential. This includes understanding the potential for increased compliance costs or enhanced market stability.

5. Retail Sector Buzz: Rumors of Major Store Closures and Expansion

Rumor Overview: Speculation is rife about major retail chains considering significant store closures or expansions in response to shifting consumer behavior and economic conditions.

Key Insights:

- Consumer Trends: Changes in retail strategies can be indicative of broader consumer trends. For instance, store closures may reflect a shift towards e-commerce, while expansions could signal growth in specific market segments.

- Investment Impact: Investors should assess how these rumored changes align with overall market trends and consumer preferences. Retail stocks may experience volatility based on these strategic shifts, making it crucial to evaluate long-term growth prospects.

- Market Analysis: Analyzing the performance of retail chains and their adaptation to evolving consumer demands can provide insights into potential investment opportunities.

Conclusion

In August 2024, trade rumors are shaping investment strategies across various sectors. By understanding the potential impact of these rumors on market dynamics and individual stocks, investors can make more informed decisions. Staying updated with reliable news sources and conducting thorough research will help in navigating the uncertainties and seizing opportunities in today’s dynamic financial landscape.