Insider trading rumors have long been a subject of fascination and concern for investors, regulators, and market analysts alike. These rumors, often driven by leaks of confidential information or speculative assertions, can have significant implications for stock market volatility. Understanding how these rumors affect the market can help investors make more informed decisions and navigate the complexities of stock trading.

What is Insider Trading?

Insider trading refers to the buying or selling of a publicly-traded company’s stock by someone who has non-public, material information about that stock. This can include executives, employees, or others who have access to sensitive information about the company. While insider trading can be legal if conducted within regulatory guidelines, trading based on confidential information not available to the general public is illegal and unethical.

How Insider Trading Rumors Affect the Market

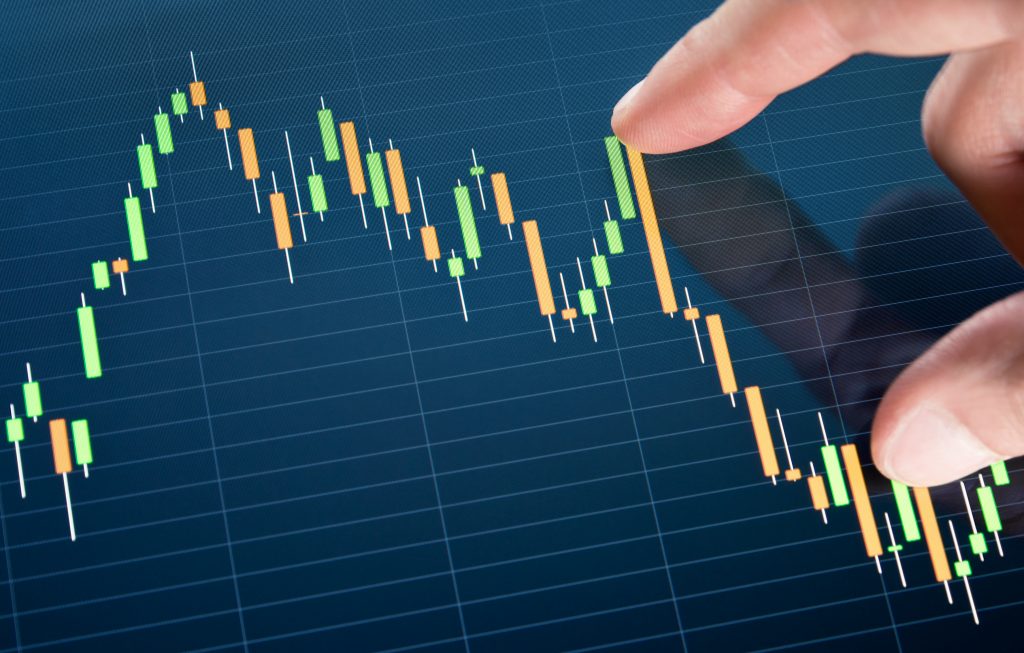

1. Increased Market Volatility

Insider trading rumors can lead to increased market volatility. When rumors circulate that a company’s insiders are buying or selling shares, it can trigger speculation and uncertainty among investors. This heightened activity often results in sharp price movements as traders react to the perceived implications of the rumor.

2. Impact on Stock Prices

Rumors about insider trading can cause significant fluctuations in stock prices. For example, if investors believe that an insider’s action indicates impending positive or negative news, they may buy or sell the stock in anticipation of a price change. This speculative trading can drive prices up or down, independent of the company’s actual performance or financial health.

3. Market Sentiment and Confidence

The spread of insider trading rumors can also affect overall market sentiment and confidence. If investors suspect that a company is engaging in illegal insider trading, it can undermine trust in the market’s fairness and transparency. This erosion of confidence can lead to broader market instability and affect other stocks and sectors.

The Role of Regulatory Bodies

Regulatory bodies such as the Securities and Exchange Commission (SEC) play a crucial role in monitoring and addressing insider trading activities. They investigate rumors and allegations, enforce regulations, and impose penalties on those found guilty of illegal insider trading. Their efforts are aimed at maintaining market integrity and protecting investors.

What Investors Need to Know

1. Verify Information

Before reacting to rumors about insider trading, investors should seek to verify the information through reliable sources. This includes checking for official statements from the company or regulatory bodies. Relying on unverified rumors can lead to misguided investment decisions.

2. Consider the Source

The credibility of the source of the rumor is important. Rumors originating from credible financial news outlets or regulatory announcements are more likely to be accurate compared to those from anonymous sources or speculative forums.

3. Monitor Market Trends

Investors should monitor broader market trends and economic indicators rather than focusing solely on rumors. This helps in making informed decisions based on comprehensive data rather than reacting to short-term fluctuations driven by speculative rumors.

4. Be Cautious with Speculative Trading

Engaging in speculative trading based on insider trading rumors can be risky. It is advisable to have a well-thought-out investment strategy and avoid making significant decisions based solely on unverified rumors.

Conclusion

Insider trading rumors can significantly impact stock market volatility, affecting stock prices, investor confidence, and overall market stability. Understanding the dynamics of how these rumors influence the market can help investors navigate their trading strategies more effectively. By verifying information, considering the credibility of sources, and monitoring broader market trends, investors can make more informed decisions and mitigate the risks associated with insider trading rumors.