In a landmark deal, SoftBank has recently announced its acquisition of the UK-based chipmaker Graphcore. This move is widely viewed as a strategic effort to bolster SoftBank’s AI initiatives and expand its influence in the rapidly growing artificial intelligence sector. The acquisition is expected to have far-reaching implications for both companies and the broader AI industry.

SoftBank’s Vision for AI

SoftBank has long been at the forefront of technology investments, with a particular focus on artificial intelligence. The company’s Vision Fund, which is one of the largest technology investment funds globally, has invested heavily in AI startups and related technologies. The acquisition of Graphcore aligns perfectly with SoftBank’s strategy to become a dominant player in the AI space.

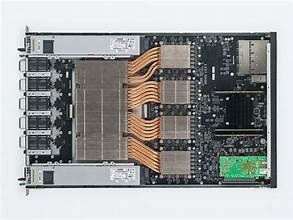

Why Graphcore?

Graphcore is renowned for its innovative approach to AI hardware. The company has developed the Intelligence Processing Unit (IPU), which is designed specifically for machine learning tasks. Unlike traditional CPUs and GPUs, IPUs are optimized for the unique demands of AI workloads, offering significant improvements in speed and efficiency. This makes Graphcore a valuable asset for any company looking to enhance its AI capabilities.

The Acquisition Details

While the financial terms of the acquisition have not been disclosed, industry analysts estimate that the deal could be worth several billion dollars. This would make it one of the largest acquisitions in the AI hardware sector. The acquisition will see Graphcore continue to operate as an independent entity under the SoftBank umbrella, allowing it to maintain its innovative culture and continue developing cutting-edge AI technologies.

Impact on the AI Industry

The acquisition is expected to have a significant impact on the AI industry. By combining SoftBank’s resources and expertise with Graphcore’s innovative technology, the two companies are well-positioned to lead the next wave of AI advancements. This could accelerate the development of AI applications across various sectors, from healthcare and finance to automotive and entertainment.

Benefits for SoftBank

For SoftBank, the acquisition of Graphcore represents a strategic investment that could yield substantial returns. By integrating Graphcore’s IPUs into its AI infrastructure, SoftBank can enhance the performance of its AI applications and reduce operational costs. Additionally, owning a leading AI hardware company gives SoftBank a competitive edge in attracting and retaining top AI talent.

Benefits for Graphcore

For Graphcore, becoming part of SoftBank provides access to a wealth of resources and a global network of partners. This could accelerate its growth and enable it to scale its operations more rapidly. Furthermore, the backing of a financially robust company like SoftBank ensures that Graphcore has the necessary funding to continue its ambitious R&D efforts.

Future Prospects

The future looks promising for both SoftBank and Graphcore. With the increasing demand for AI solutions across industries, the need for specialized AI hardware is also on the rise. By joining forces, SoftBank and Graphcore are well-positioned to capitalize on this trend and drive innovation in the AI hardware market.

Strategic Synergies

The synergies between SoftBank and Graphcore extend beyond financial and technological benefits. SoftBank’s extensive portfolio of AI and technology companies provides numerous opportunities for collaboration and cross-pollination of ideas. This could lead to the development of new AI solutions that leverage Graphcore’s IPU technology, further cementing SoftBank’s position as a leader in the AI industry.

Market Reactions

The market has responded positively to the acquisition announcement, with analysts praising the strategic rationale behind the deal. SoftBank’s stock saw a modest increase following the news, reflecting investor confidence in the company’s AI strategy. Meanwhile, industry observers are keenly watching how the integration of Graphcore will unfold and its impact on the competitive landscape.

Conclusion

SoftBank’s acquisition of Graphcore is a bold and strategic move that underscores its commitment to advancing AI technologies. By acquiring a leading AI hardware company, SoftBank is not only enhancing its own AI capabilities but also positioning itself as a key player in the AI industry. As the integration process begins, the industry will be watching closely to see how this partnership evolves and the innovations it brings to the market. This acquisition is not just a business transaction; it is a significant step towards shaping the future of artificial intelligence.